Introduction

Private Retirement Scheme, or PRS, is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. PRS seeks to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment.

The Importance of Saving For Retirement

Longer Life Span

With the medical advances, people are living longer than ever, and it’s not unrealistic to expect that your post-retirement life could be up to 20-30 years. This means you’ll need substantial nest egg to ensure that you don’t outlive your savings and to have a comfortable lifestyle during your retirement days.

Beat Inflation

With the challenging market environment, the impact of inflation over the years will impact your purchasing power, thus, it is important to look at investing to grow your monies to beat inflation and not just merely depend on your savings to retire.

Insufficiency in Mandatory Retirement Saving

Active contribution to one’s EPF account alone may be insufficient for achieving one’s retirement goals. Malaysians would need to explore other avenues to give their golden years’ nest egg a boost and an alternative to consider is PRS.

Benefits of Contributing in Private Retirement Scheme (PRS)

Flexible & Variety

Choose from a variety of PRS funds based on your risk appetite or follow PRS life cycle investment.

Regulated Investment

The PRS is regulated by the Securities Commission Malaysia ("SC") and safeguarded by the fund trustee.

Affordable

RM100 as minimum initial investment amount. RM50 as minimum additional investment amount.

Supplement Retirement Nest

The PRS is a supplementary form of retirement savings in addition to the mandatory retirement savings.

Protection

PRS are protected from creditors' claim as stated in Section 139ZA of Capital Market and Services Act.

Tax Relief

Eligible up to RM3,000 personal tax relief per year.

PRSPro Plan

Eligible for a Complimentary Takaful Coverage up to RM100,000.

Who can Contribute in PRS?

Malaysians & foreigners

Employed or self employed

Age 18 and above

Also suitable for individuals who do not have a public mandatory retirement scheme.

Getting Started By Choosing Your Approach

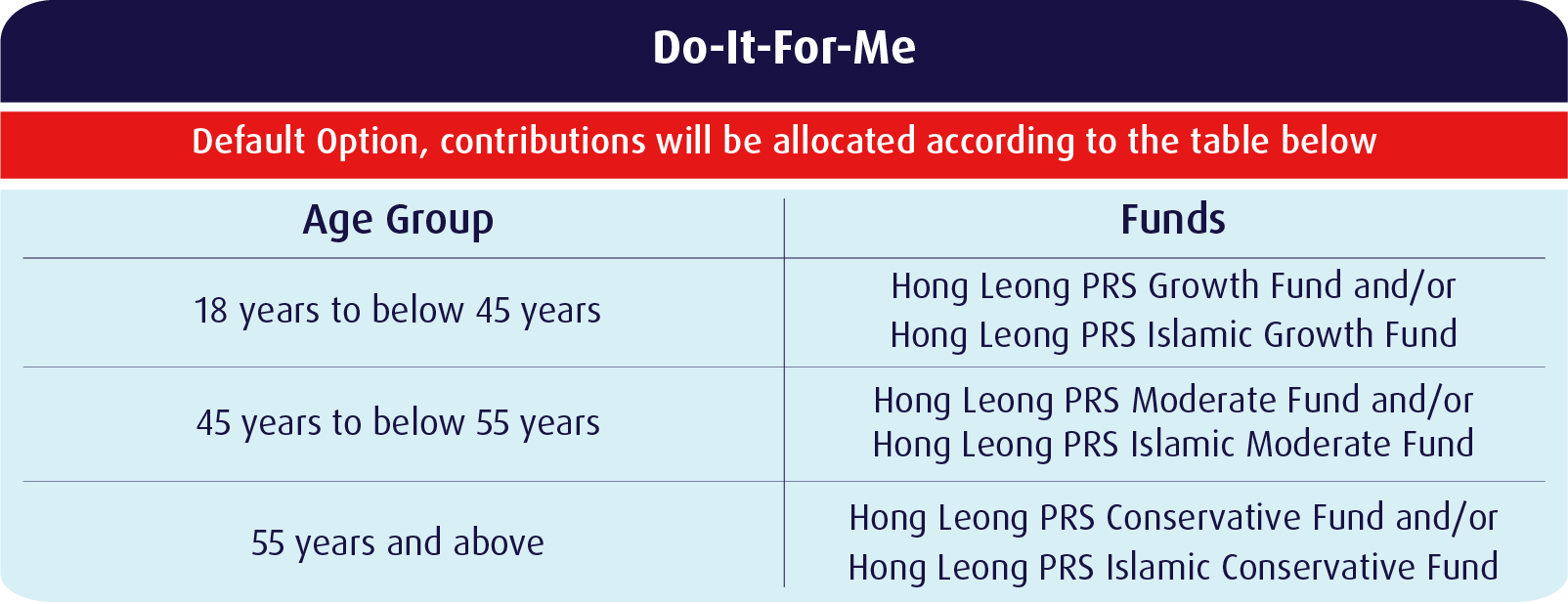

Do-It-For-Me: The suitable fund will be automatically selected based on your age.

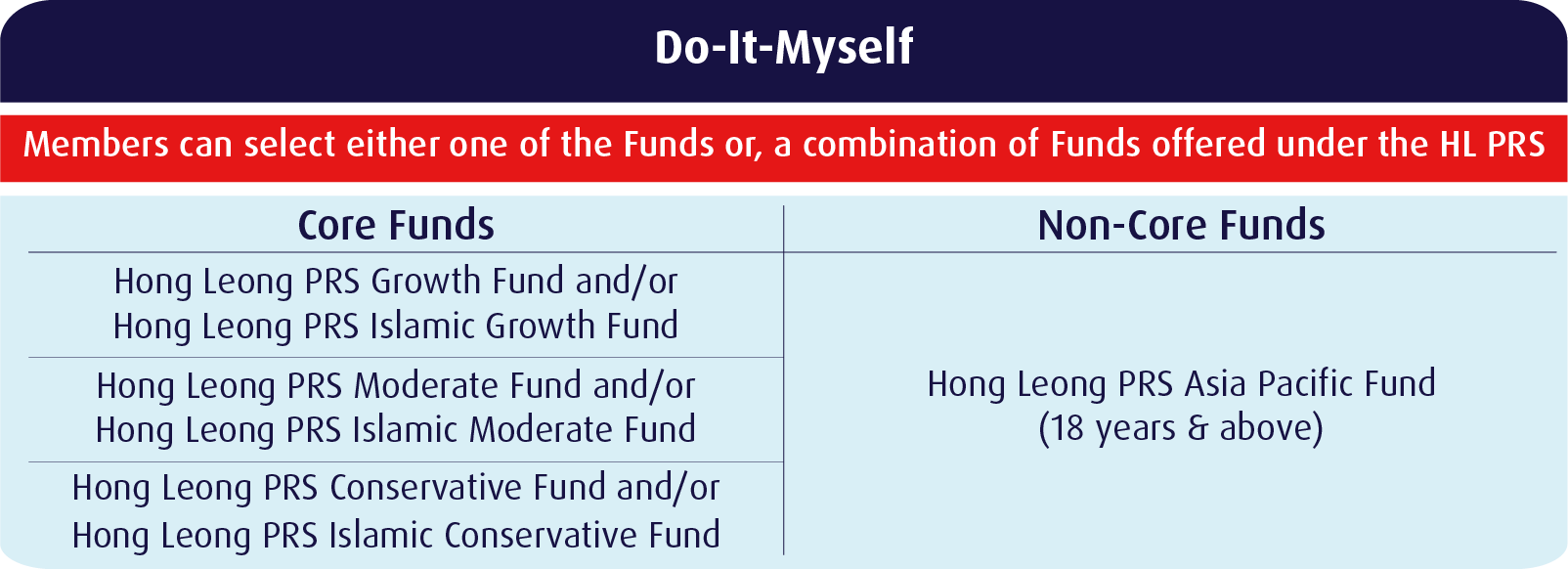

or, Do-It-Myself: You can choose the fund(s) that best suit you. This option is for those who prefer to manage their own investment.

HL PRS – Conventional

Fund Details - Hong Leong Private Retirement Scheme – Conventional

The minimum initial investment amount is RM100 and the minimum additional investment amount is RM50 or such other amount as the Provider may in its sole discretion allow.

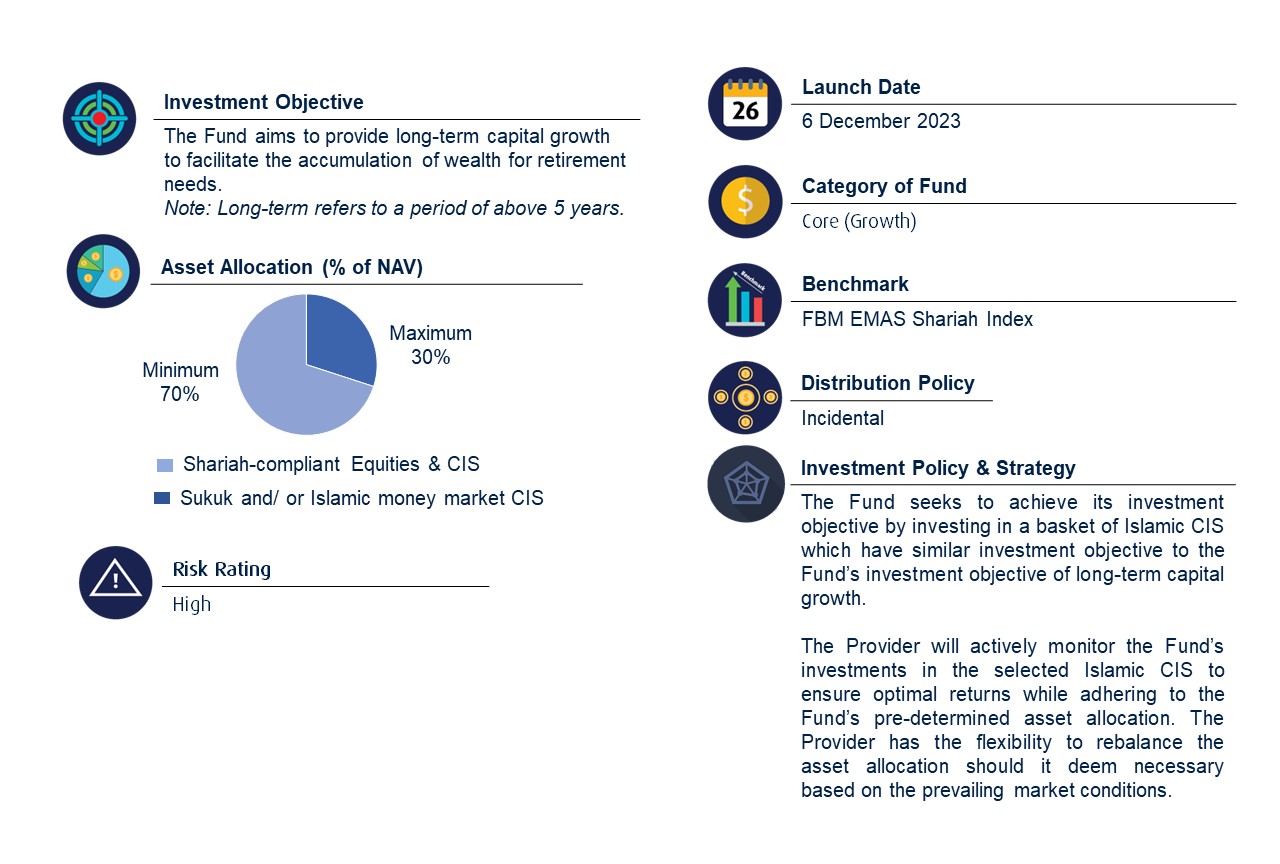

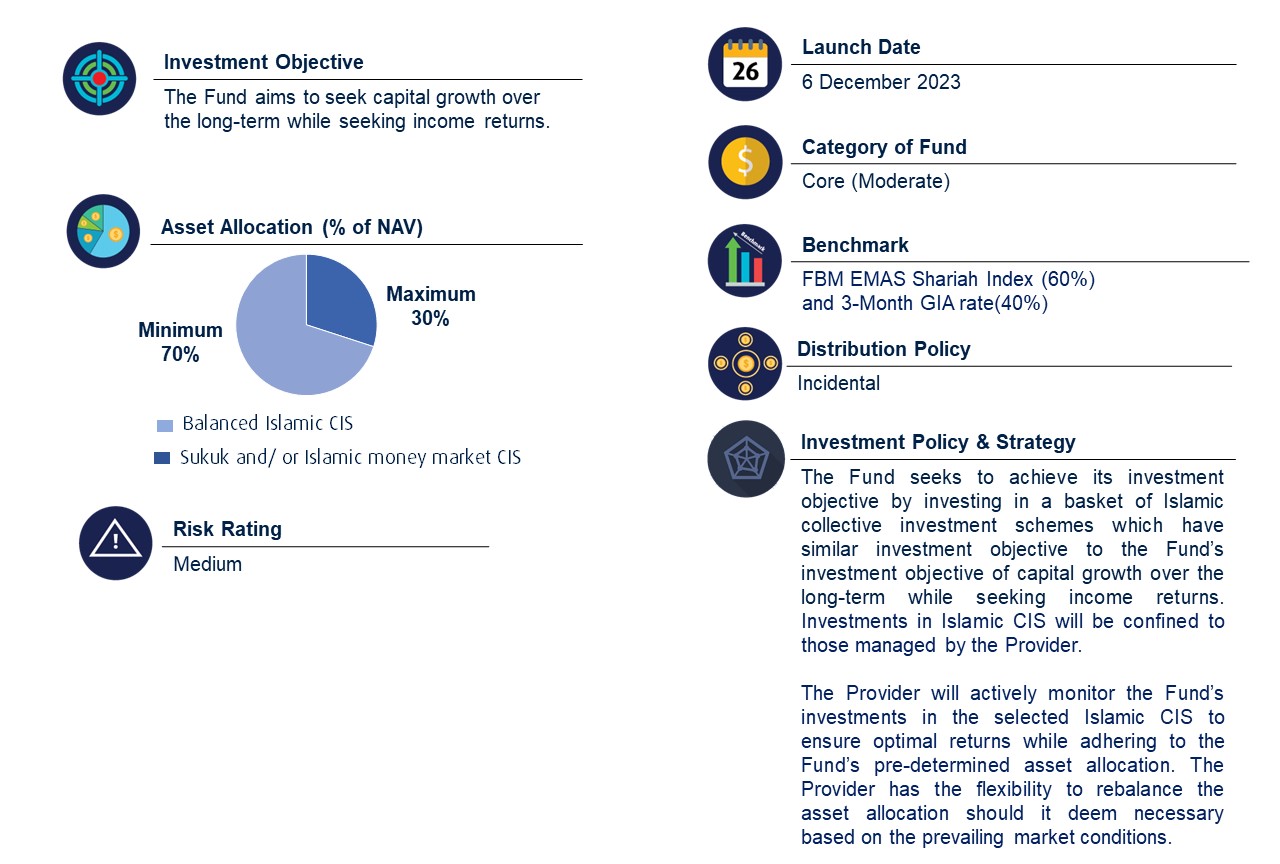

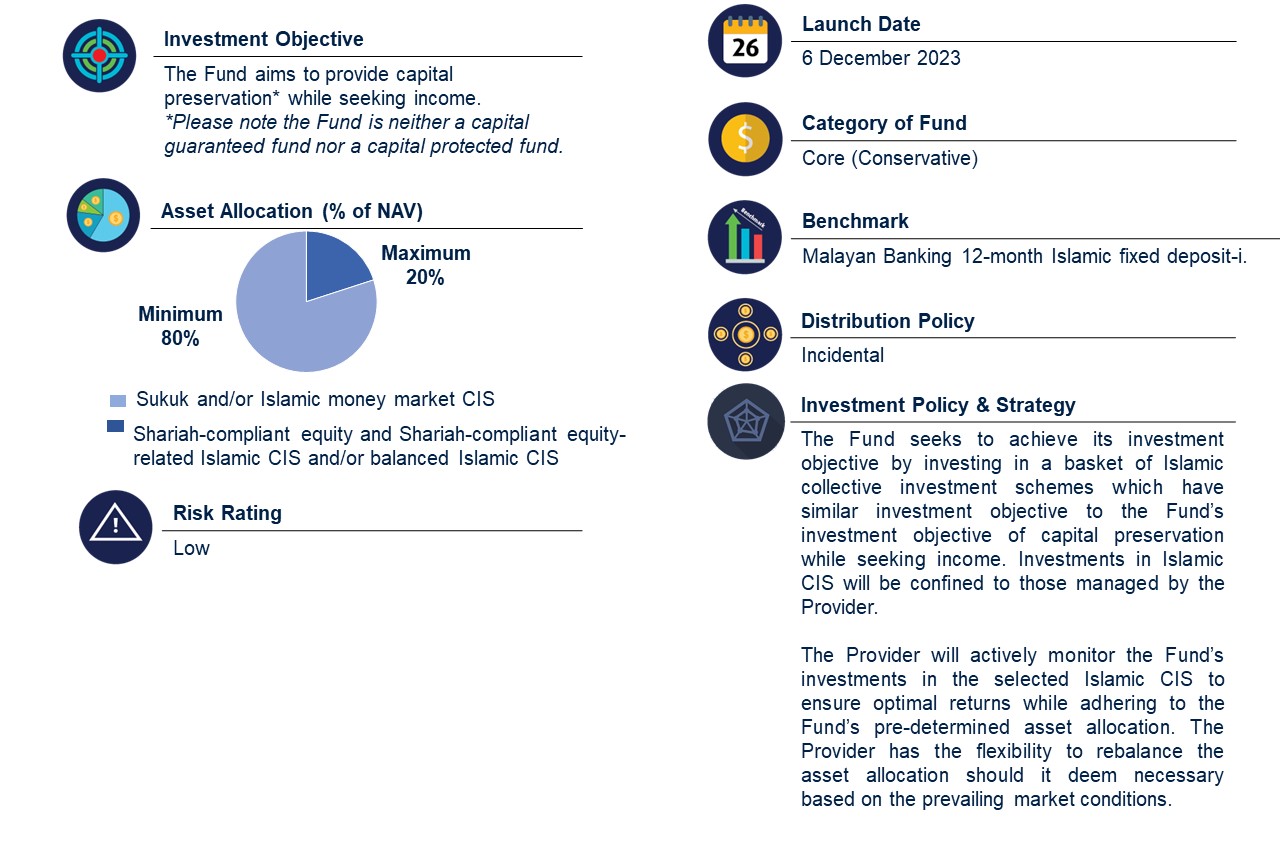

HL PRS – Islamic

Fund Details - Hong Leong Private Retirement Scheme – Islamic

The minimum initial investment amount is RM100 and the minimum additional investment amount is RM50 or such other amount as the Provider may in its sole discretion allow.