ESG Investing

Environmental, Social & Governance ("ESG") Investing refers to investing which prioritises optimal ESG factors or outcomes. The considerations are grouped into three categories. A few examples of factors affecting each of these 3 categories:

Holistic approach to ESG investing is adopted which prioritising optimal ESG factors or outcomes. The considerations are grouped into three categories:

Wake Up Call: ESG Becoming Mainstream & New Normal

The pandemic has unveiled the power of unanticipated events. During the unprecedented years, corporations and investors are realising the need to drive the call for sustainability, the need for a different approach to investing and engaging positive change.

- Climate Action 100+ urging companies to set net zero emissions targets and plans, and hold them accountable.

- Greater scrutiny over Malaysian products e.g. palm oil and rubber gloves over labour and sustainability concerns.

- Malaysia has introduced sustainability policy and incentive schemes, for example: large scale solar, green technology and socially responsible investment fund.

The Rising of ESG Concerns and Impacts

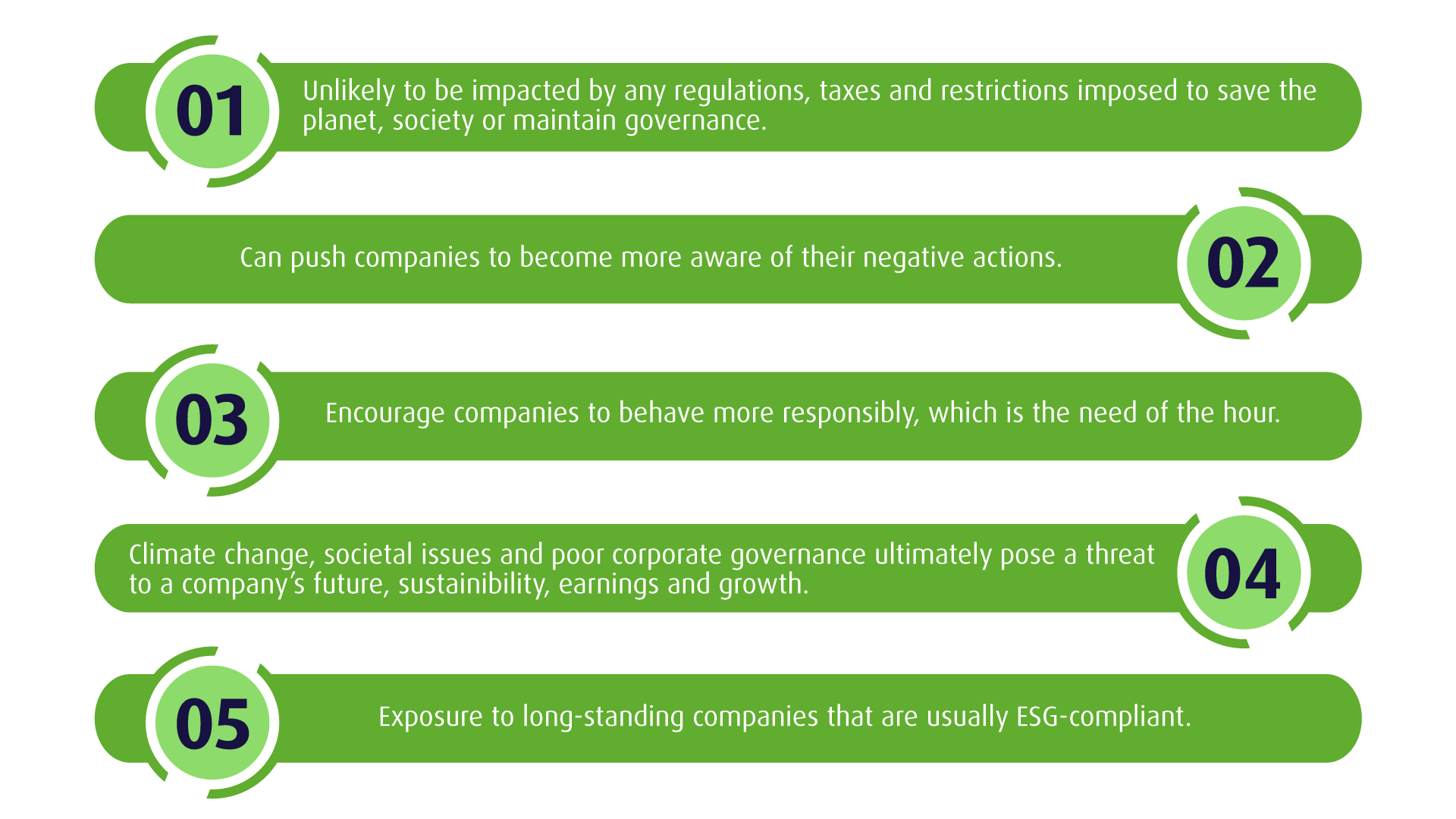

Benefits of ESG Investing

Our Investment Solutions

Exclusive Distribution through

Hong Leong Bank’s branches nationwide and Hong Leong AM offices.

Introduction

HONG LEONG GLOBAL ESG FUND

Hong Leong Global ESG Fund is a global equity fund aiming to provide medium to long-term capital growth by investing in a globally diversified portfolio of companies with a focus on Environmental, Social & Governance (ESG) criteria in the investment process.

Holistic approach to ESG investing is adopted which prioritising optimal ESG factors or outcomes. The considerations are grouped into three categories:

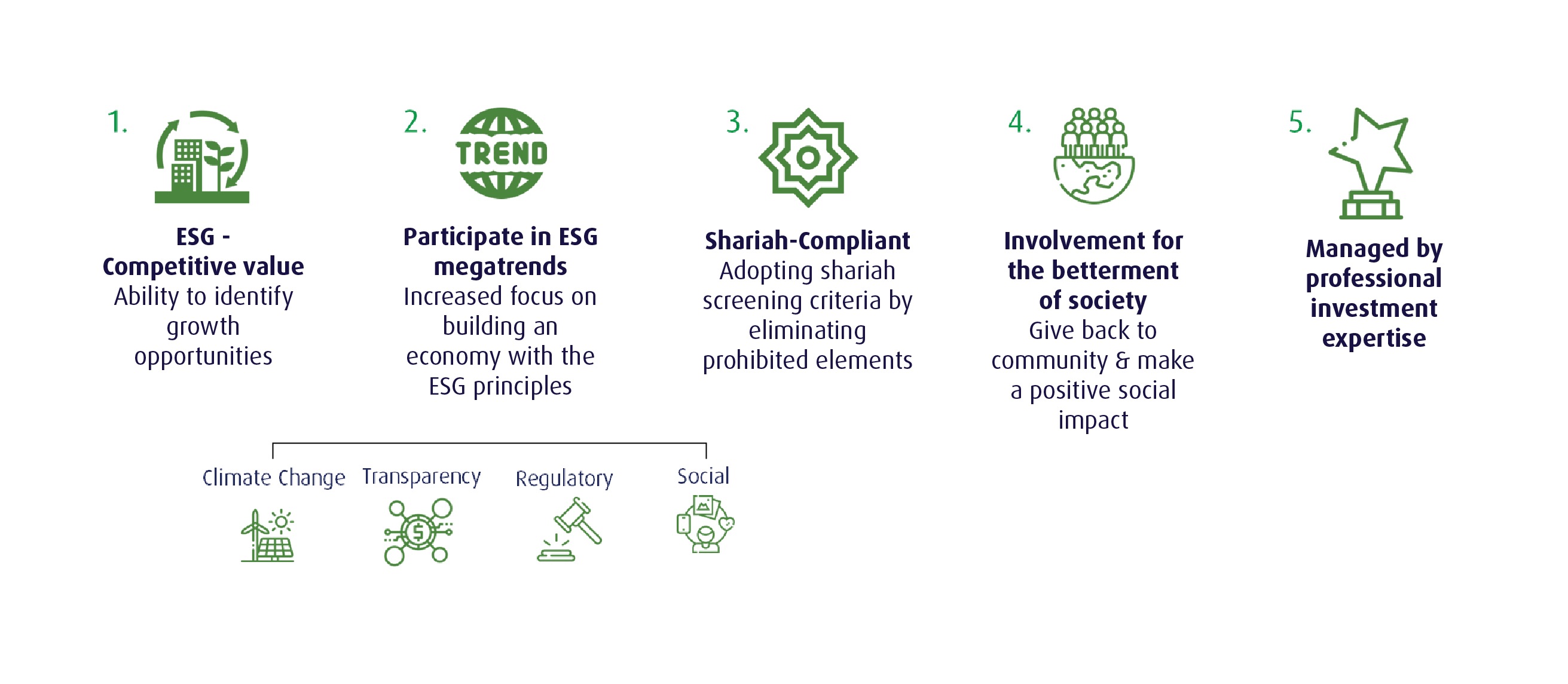

Why Invest In Hong Leong Global Esg Fund?

Exposure to companies which incorporate ESG into their businesses.

Provide socially conscious investors the opportunity to align their investments with their values through ESG investing.

ESG integration into the investment process lowers risk and/or enhance returns.

ESG Outperformance

Listed companies that identify and address ESG risks and opportunities are more likely to outperform those that do not, because they are better equipped to tackle the impact from adverse events such as extreme climate conditions.

Holistic approach to ESG investing is adopted which prioritising optimal ESG factors or outcomes. The considerations are grouped into three categories:

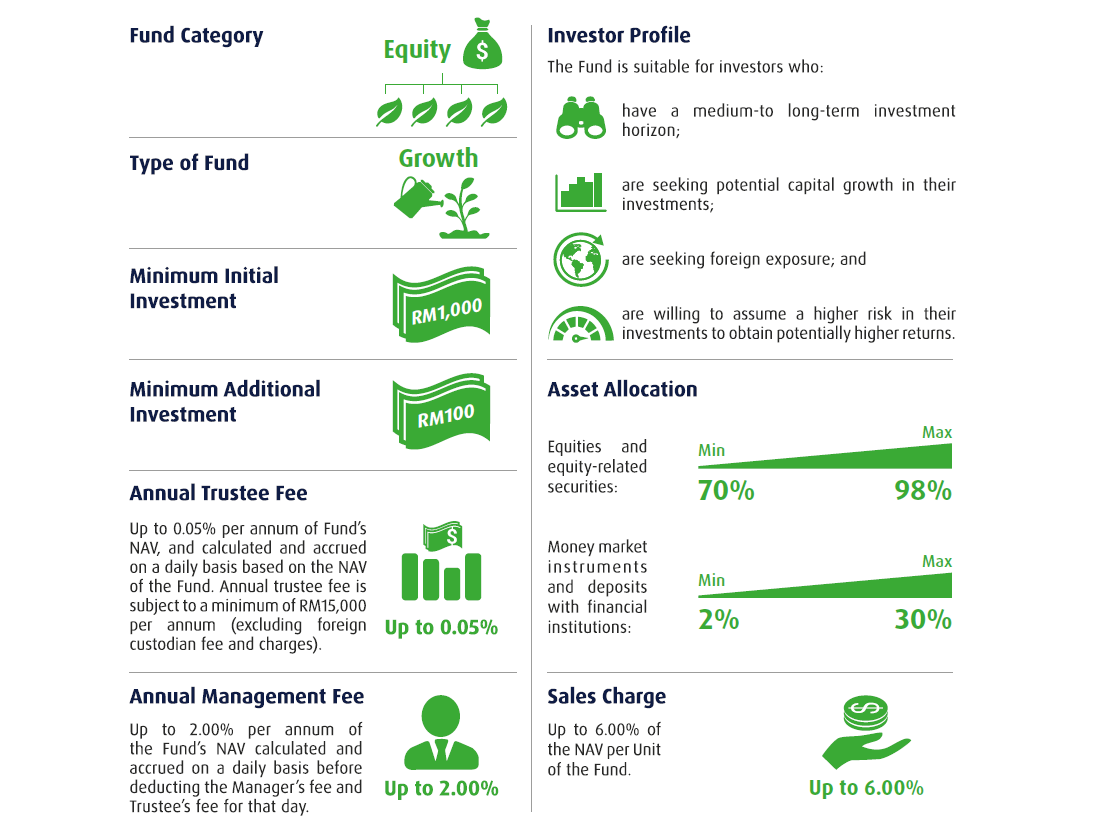

The Fund Details

Listed companies that identify and address ESG risks and opportunities are more likely to outperform those that do not, because they are better equipped to tackle the impact from adverse events such as extreme climate conditions.

Holistic approach to ESG investing is adopted which prioritising optimal ESG factors or outcomes. The considerations are grouped into three categories:

Click here to learn more about the fund.

Exclusive Distribution through

Hong Leong Bank’s branches nationwide and Hong Leong AM offices.

Video

Introduction

HONG LEONG GLOBAL SHARIAH ESG FUND

The increased awareness on the importance of sustainable living has influenced people to be more mindful about making sustainable choices in their daily lives, for example: recycling household waste, practising upcycling & reusing items, choosing organic food and opting for greener ways to travel wherever possible.

Other than what is happening in our daily lives, other global challenges like inequalities, deforestation, climate change and the pandemic have also brought attention to both corporates and individuals on the importance of sustainable development to achieve a better and sustainable future for all.

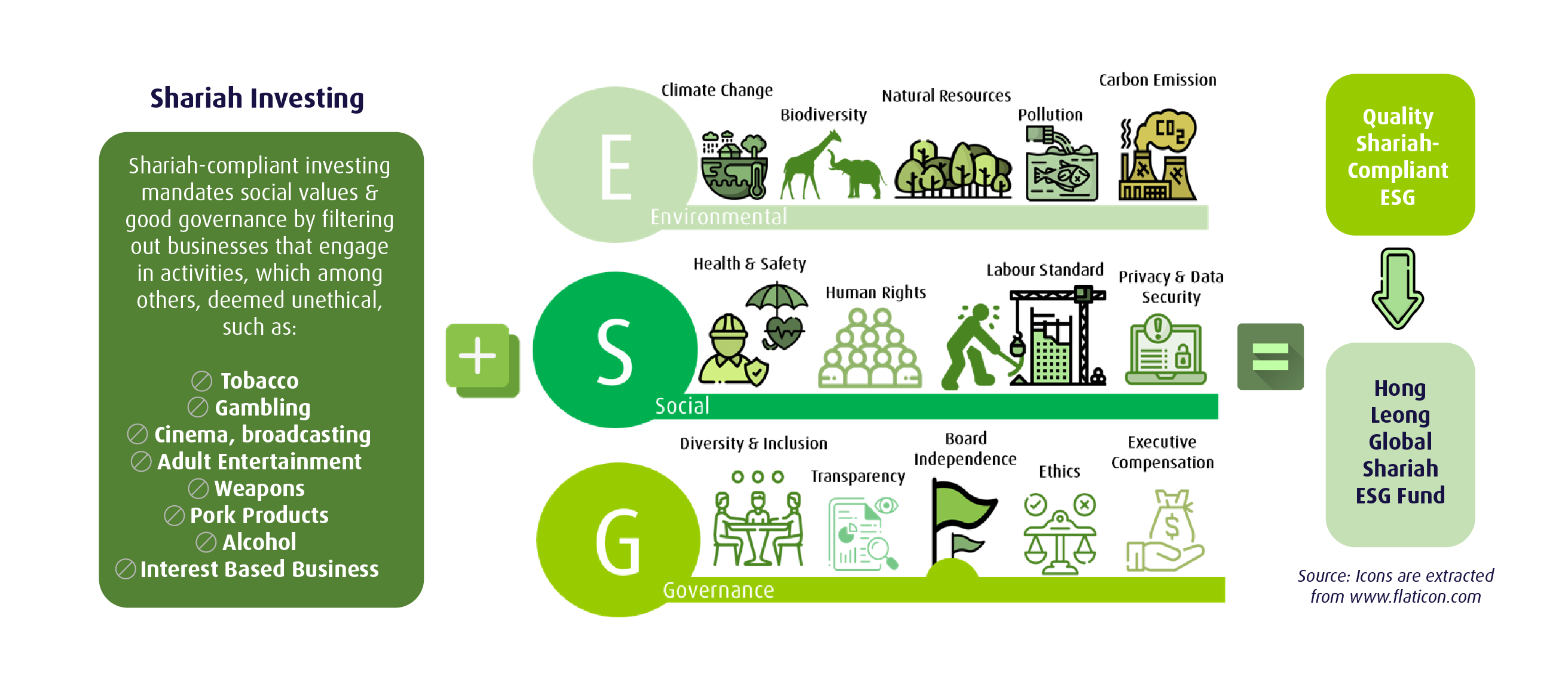

At a glance, this is how Shariah and ESG investing work:

Investment Objective

The Fund aims to provide medium-to long-term capital growth by investing in a globally diversified Shariah-compliant portfolio of securities with a focus on ESG criteria in the investment process.

Key Features

Access to diversified portfolio of Shariah-compliant global stocks which focus on ESG.

Participate in Shariah-compliant sustainable investing via integration of ESG considerations in the investment process

Potential long-term capital growth through sustainable investing.

Why Invest In Hong Leong Global Shariah Esg Fund?

The Fund Details

Click here to learn more about the fund.

HLGSESGF is exclusively distributed through Hong Leong AM offices and agency forces nationwide, as well as digitally via HL iSmart Invest.